THE ADVISER’S NOTEBOOK

APRIL 2022

CONTENTS

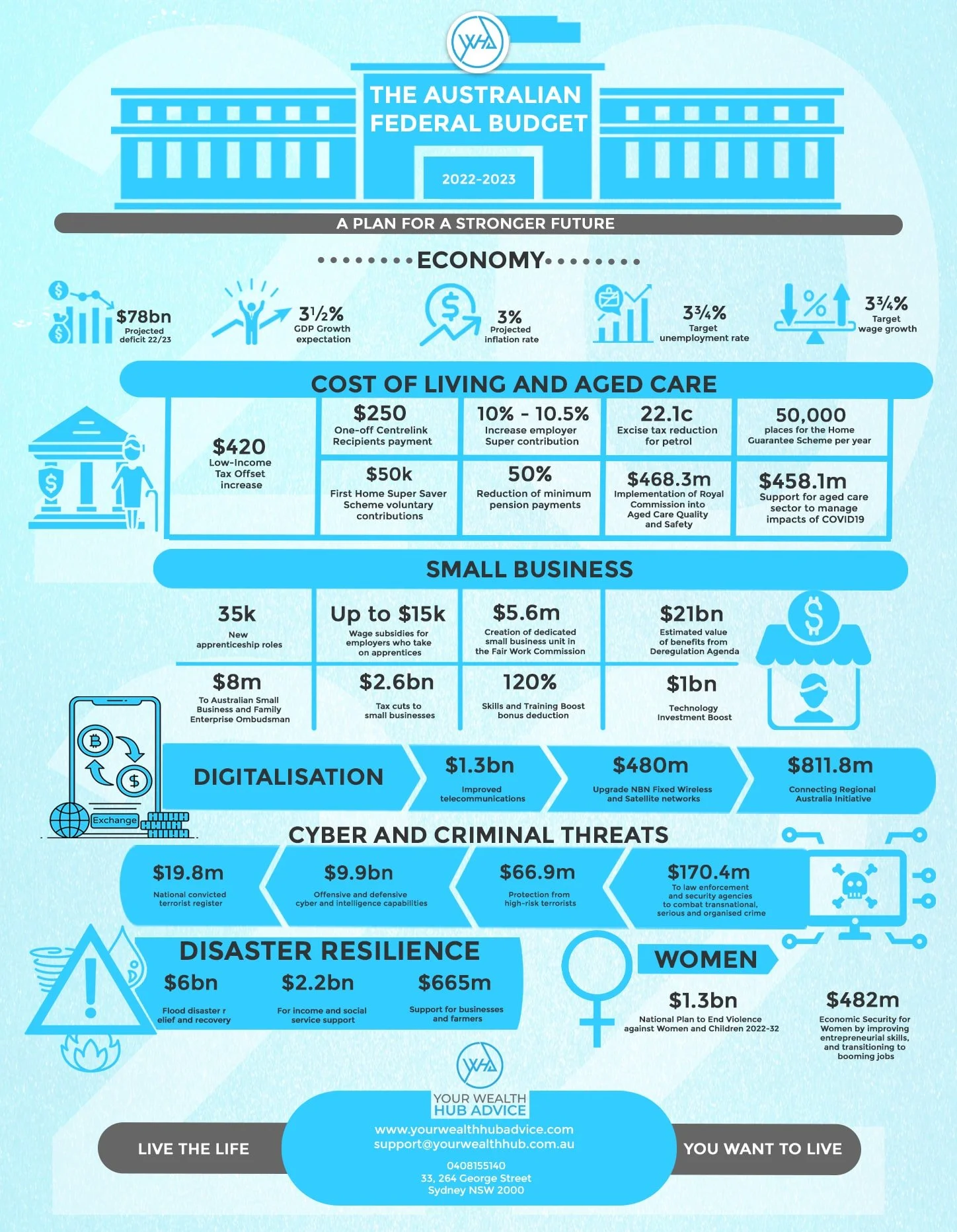

THE 2022 FEDERAL BUDGET EXPLAINED

RBA KEEPS INTEREST RATES ON HOLD

THE YIELD CURVE HAS INVERTED

EXPANDED HOME LOAN GUARANTEES PROS AND CONS

5 INVESTING CHARTS USEFUL IN UNCERTAIN TIMES

THE RICHEST PEOPLE IN THE WORLD 2022

SCROLL THROUGH THE STORY REEL BELOW

Welcome to the April edition of The Adviser’s Notebook!

We have had some major changes occur in March and April already with the budget in full effect and the May federal election on the horizon.

Firstly, both the labour party and the coalition included some details of the expansion of the first home loan deposit scheme in their policy platforms. This move offers some pros and cons, which you'll read about below.

If you haven’t already, you can check out our 2022 Federal Budget infographic that summarises some of the critical allotments in specific sectors, as well as the accompanying article that talks about how the budget changes will affect you.

Interest rates have remained on hold for April, with the Reserve Bank taking a ‘patient’ approach on rates for now. However, with inflation at 3.5% and tipped to go higher, the RBA is expected to begin lifting rates later this year. Understand how this affects you and the so-called 'yield curve.'

In these turbulent economic times, it is important to stay focused on the basic principles of successful investing. This is why we have included an article on the five great charts to help illuminate the key aspects of investing. These are the power of compound interest; the investment cycle; the roller coaster of investor emotion; the wall of worry; and time is on your side.

Finally, the world’s billionaires have amassed $5 trillion since March 2021 alone. Do you know who has made it into the highest ranks?

The Team at YWHA wishes you a safe and Happy Easter and Anzac Day long weekend. We hope you enjoy some time out with family and friends.

Gavin Glozier, AdvFP

CEO & Principal Financial Adviser

P 1300 763 498 • M 0408 155 140

Level 33, 264 George St NSW, Australia

Life the life you want to live.